Information for Investors and M&A Proposals

Euregio.Net AG is a privately held, family-owned business. It was founded in 1995. The business consists of 2 major divisions: the local ISP business and the international entertainment network.

Several times a month, we get inquiries from potential suitors who are looking to buy an existing network to bolster their own properties.

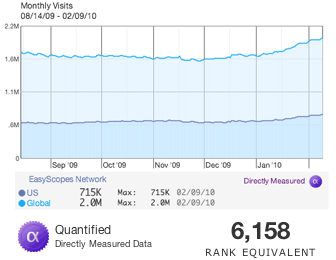

While we are open to discussing a potential sale of our entertainment network, most suitors won't have the necessary funds. We're estimating the value of our network in the seven figure range - a few multiples of the monthly visitor count.

In the past, we negotiated with startups and NASDAQ-listed companies about selling our entertainment sites to them. The highest price agreed upon was $17 million before the dot-com bubble bust. In the end we couldn't agree with the proposal because it was an all stock deal. We were very happy with our decision as the share price of the buyer dropped from $25 to $0.25 in a matter of months.

Should we decide to sell the network, then it will be in an all cash deal. We won't sell separate parts of the networks as it is interwoven. The different sites are used for cross-promotion to keep web site visitors on our network. The network as a whole is much more worth than the individual sites. Individual domain names will also remain in our portfolio as they are used for various promotion activities.

M&A discussions take up a lot of time and incur legal, advisory and travel costs. So we'd like to keep these discussion to minimum unless a potential suitor can convince us about their seriousness and their budget.

If you are looking to buy an established entertainment network for teenage girls and young women and you've got the necessary funds, then don't hesitate to contact us to find out if we might be interested. Please provide some of your company background information.

If you're a serious investor with a vision and the budget, then please contact us...

Our financial advisors are with the mangement consulting group THG.

Our legal advisors are with the law firm of CMS Debacker.